What is the Volume Indicator? The Volume Indicator shows the number of units of an asset traded over a specific period. In cryptocurrency trading, volume reflects the amount of cryptocurrency bought or sold in the market during a given time frame. Volume is an important indicator because it helps traders understand how significant a price movement is and whether the market supports that movement.

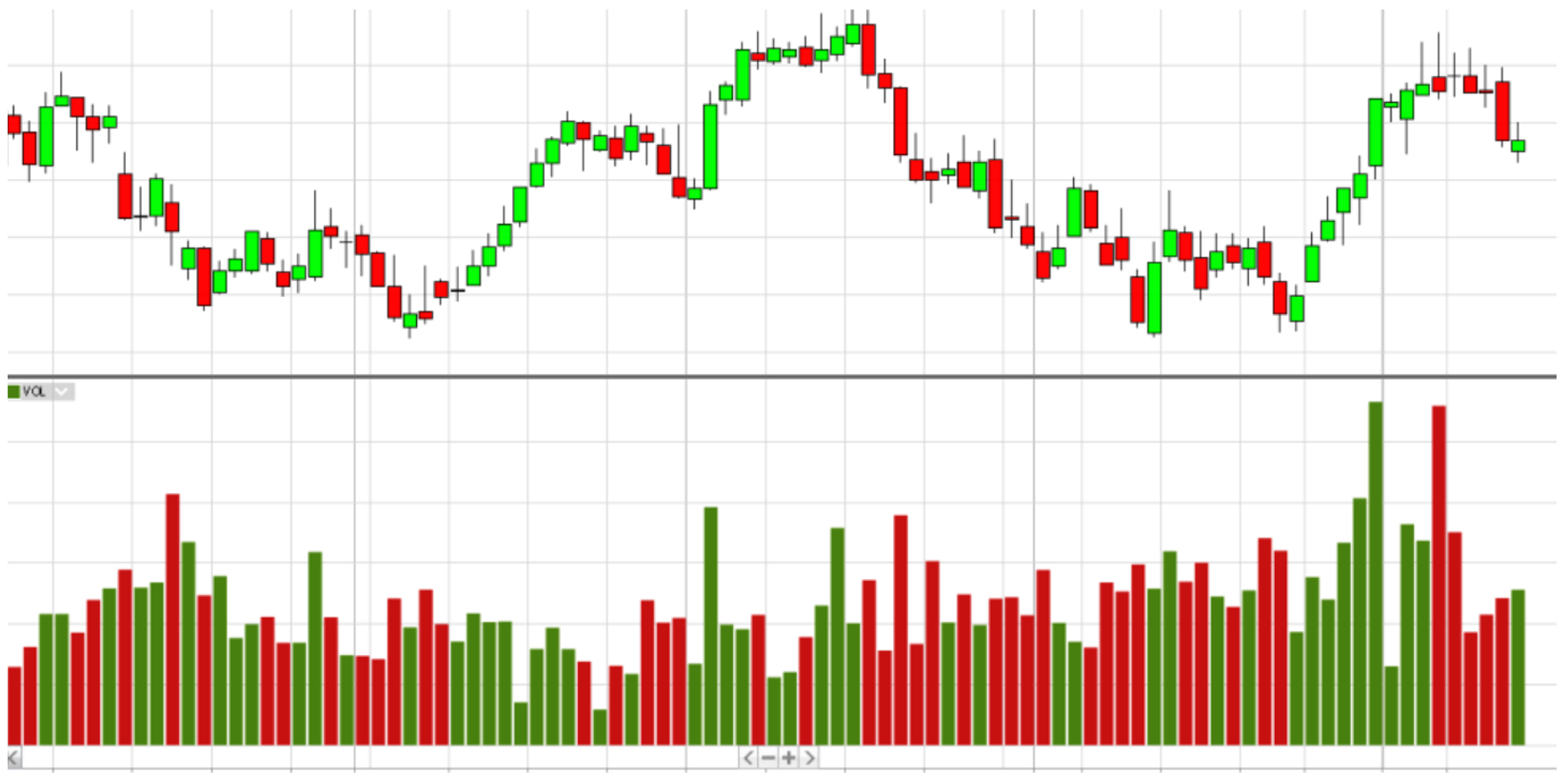

How Does the Volume Indicator Work? Volume is typically displayed as bars on a histogram beneath the price chart. Each bar represents the trading volume for a specific period (e.g., an hour, day, or week).

Key Volume Indicator Signals:

- High Volume: Supports the price movement, indicating its strength and the likelihood of continuation.

- Low Volume: May signal weakness in the movement, potentially leading to its weakening or reversal.

- Volume and Reversals: A sudden increase in volume at the peak of a trend may signal its reversal.

Using the Volume Indicator in Cryptocurrency Trading Volume is used in various strategies to confirm price movements, determine trend strength, and identify possible entry and exit points.

Strategy Examples:

- Trend Confirmation: If the price of Bitcoin (BTC) starts to rise and volume also increases, this may signal the strength of the uptrend.

- Example: If the price of Ethereum (ETH) is rising and trading volume increases, this confirms the strength of the movement, and traders might consider opening long positions.

- Volume Divergence: If the price of Ripple (XRP) continues to rise, but volume begins to decrease, this may indicate a weakening trend and a possible downward reversal.

Using Volume with Other Indicators:

- Volume and MACD: If MACD gives a buy signal and this signal is accompanied by an increase in volume, it may be a strong confirmation to enter the trade.

- Volume and RSI: If RSI indicates oversold conditions and volume begins to increase, this could signal an impending trend change.

Advantages and Disadvantages of the Volume Indicator

Advantages:

- Movement Confirmation: Volume helps confirm the strength of a price movement.

- Reversal Identification: A sudden increase in volume may signal a possible trend reversal.

- Versatility: The Volume Indicator can be used on all timeframes and for any assets.

Disadvantages:

- Interpretation Difficulty: Volume can sometimes be difficult to interpret, especially in low liquidity conditions.

- Not Always Effective Alone: Volume is best used in combination with other indicators to improve signal accuracy.

Conclusion The Volume Indicator is an essential tool for any cryptocurrency trader. It helps to understand how well a price movement is supported by the market and whether it is sustainable. By combining volume with other indicators such as MACD, RSI, or Bollinger Bands, traders can make more informed decisions and better manage their positions.

If you missed our previous articles on technical indicators like MACD and ATR, be sure to read them to learn how these indicators can help you analyze the cryptocurrency market.