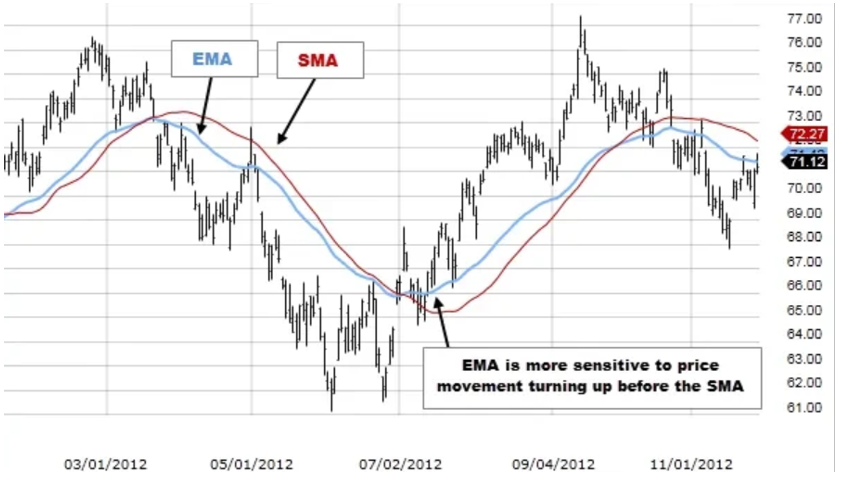

What is EMA? The Exponential Moving Average (EMA) is a type of moving average that places more emphasis on the most recent price data, making it more responsive to price changes compared to the Simple Moving Average (SMA). As a result, the EMA reacts more quickly to current market conditions, making it particularly useful in volatile cryptocurrency markets.

How is EMA Calculated? The calculation of the EMA starts with the Simple Moving Average (SMA) over a specified period, after which a smoothing factor is applied, giving more weight to the most recent data.

Advantages and Disadvantages of EMA

Advantages:

- Quick Response: The EMA reacts faster to price changes than the SMA, making it useful for identifying short-term trends.

- Flexibility: The EMA can be used across various timeframes and for different assets, including cryptocurrencies.

- Suitable for Volatile Markets: Due to its sensitivity to changes, the EMA is particularly effective in volatile markets such as the cryptocurrency market.

Disadvantages:

- More False Signals: Due to its sensitivity, the EMA may generate more false signals in the presence of market noise.

- Less Stability: The EMA can be less stable during sharp price fluctuations, requiring more careful analysis when used in combination with other indicators.

Using EMA in Cryptocurrency Trading The EMA is widely used to identify trends and their reversals. It can also serve as a dynamic level of support or resistance.

Strategy Examples:

- EMA Crossover: Traders often use the crossover of two EMAs (e.g., 12-period and 26-period) to generate buy or sell signals. If the shorter EMA crosses above the longer EMA, it’s a buy signal. If it crosses below, it’s a sell signal.

- Example: If the 12-day EMA on the Bitcoin (BTC) chart crosses above the 26-day EMA, it may signal the start of an uptrend.

- EMA as Support or Resistance: The EMA can be used as a dynamic level of support or resistance. For example, traders might consider buying if the price bounces off the 50-day EMA during an uptrend.

EMA in Combination with Other Indicators:

- EMA and MACD: The EMA is used in calculating the MACD, making it an important component for analyzing momentum and trends.

- EMA and RSI: Combining the EMA with an oscillator like the RSI can help traders identify entry and exit points based on overbought or oversold conditions.

Conclusion The Exponential Moving Average (EMA) is a powerful tool in the arsenal of a cryptocurrency trader. It allows for quicker reactions to price changes and better consideration of current market conditions. However, like any other indicator, the EMA should not be used in isolation. Combining the EMA with other indicators, such as MACD or RSI, will help traders make more informed decisions and minimize risks.

If you missed the article on the Simple Moving Average (SMA), be sure to read it to understand how this fundamental indicator helps determine trends in the cryptocurrency market.

Don't miss our next article, where we will discuss Bollinger Bands in detail—one of the most popular indicators for analyzing volatility in the cryptocurrency market.